In July, the HSRC’s Centre for Science, Technology and Innovation Indicators (CeSTII) was shortlisted for the 2022 NSTF-South32 Awards for its national survey of research and development (R&D) in South Africa. The survey points to a drop in business R&D over the past decade and, equally concerning, a decline in research personnel. The leader of the survey team, Dr Nazeem Mustapha, spoke to The Review about the importance of monitoring R&D, and how South Africa can improve its business R&D and build skills.

“To have economic development, you need to have a strong research and development component,” says the HSRC’s Dr Nazeem Mustapha. Research and experimental development (R&D) not only refer to the development of new products, but can also be about maintaining or improving existing products, processes or services – such as those supplied by state-owned enterprises like Eskom, for example. Each year Mustapha leads an HSRC team that, on behalf of the Department of Science and Innovation, surveys R&D expenditure and capabilities across five sectors: higher education, science councils, government, business, and not-for-profit organisations.

The annual National Survey of R&D has been informing government policies, investment planning, advocacy, and research for over 50 years. At that time, R&D was a political priority because of the sanctions that South Africa faced under apartheid. One of the state-owned enterprises of that era, Sasol, went on to become a global leader not only in energy, but in chemical by-products of the Fischer–Tropsch process, Mustapha says. In 2003 the HSRC team took responsibility for the survey, with Dr Mario Clayford and Natalie Vlotman in charge of operations. Today the survey statistics are a key source of information for the 2019 White Paper on Science, Technology and Innovation and the STI decadal plan, which aim to identify new sources of economic growth and to achieve inclusive, sustainable development.

The survey runs according to international standards, overseen by the intergovernmental Organisation for Economic Co-operation and Development for benchmarking and comparison. Locally, it must meet standards set by Statistics South Africa for the findings to be certified as national or official statistics, says Mustapha. “We achieved that even during the COVID-19 lockdown. This consistent high-quality performance is likely the reason we were shortlisted for the NSTF-South32 Awards. We’ve been doing this for almost 20 years, and essentially we get it right every time.”

Three key trends of the past decade

According to Mustapha, the past decade of R&D patterns in South Africa paints a worrying picture in terms of economics, even as R&D in the public sector offers glimmers of hope.

Business R&D expenditure has taken a dive

The biggest trend is that R&D expenditure, especially in the business sector, has been declining for the past decade. In 2011/12, the proportion of R&D done by the business sector was greater than 50%. Since then, it has been consistently dipping below the halfway mark, with the 2019/20 figure at around 40%.

“This is significant, because one indicator that distinguishes developed from developing countries is the proportion of total R&D that the business sector does. If it’s above 50%, you’re almost certainly looking at a developed country; if it’s below, it’s probably a developing country.”

How much R&D is performed by the business sector is linked to whether multinationals and foreign funders consider the country a good location for R&D. It’s also about investment strategies in new technologies – whether local companies decide to invest in R&D or to license technologies from elsewhere.

We’ve shed R&D personnel

The decline in performance abilities in R&D is far more critical than the loss of spending, according to Mustapha. “While you can switch expenditure on again, depending on economic circumstances, it’s far more difficult to replace personnel. We need to rebuild all of that expertise, and building expertise means that you are actually a step further back.”

South Africa shines in space science

Space science has emerged as the flagship science of South Africa. “We spend a lot on space science, and we also get cited a lot for the research we do, so that’s probably the one standout area.”

Other important areas for R&D are converging technologies like nanotechnology and biotechnology, and HIV/AIDS, malaria and TB. The 2019/20 survey results show that the greatest amount of R&D activity in research fields takes place in the medical and health sciences (21.5%), followed by the social sciences (16.9%).

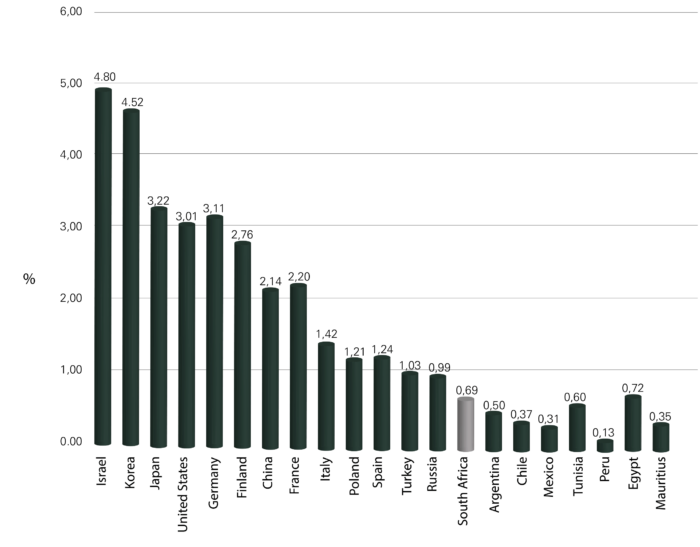

R&D intensity in selected countries (2018)

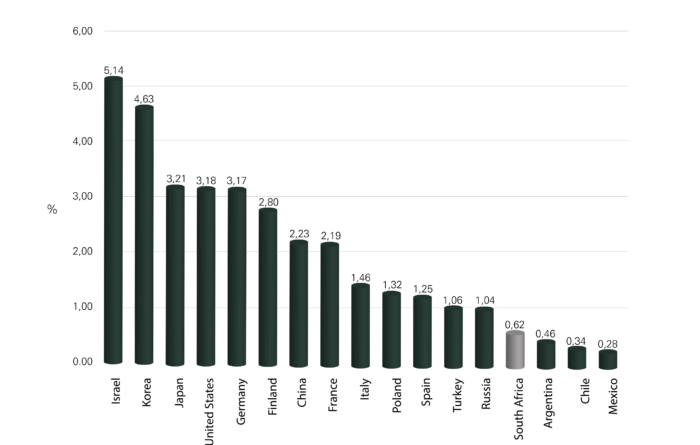

R&D intensity in selected countries (2019)

Powering an increase in business R&D

Addressing the energy crisis is critical to creating an environment that multinational companies and international sources of funding consider conducive to R&D, Mustapha says.

To encourage scientific or technological R&D activities among local companies, the government has offered an R&D incentive since 2006. Companies that perform R&D according to a definition broadly consistent with the National Survey of R&D are eligible to receive that money back, plus 50%. This translates into a saving of 14c for every rand spent on R&D, at a corporate tax rate of 28%. According to a government report, large companies in the manufacturing sector are the primary beneficiaries of the incentive.

The incentive is due to lapse in September 2022, and discussion is underway to determine whether it will be extended and, if so, in what form. “Unfortunately, our survey does not count R&D projects,” Mustapha says. “To assess the impact, we have to find out if the system as a whole is actually increasing the number of new R&D projects and whether it is impacting GDP.”

Influence the decision makers

According to Mustapha, South Africa needs more R&D projects to attract and retain researchers and R&D personnel. “It starts with a commitment: the CEO of a particular company has to make a decision to perform R&D. So, the decision makers are the people you have to influence and incentivise to do R&D. If a company doesn’t have the commitment to do new projects, it could still get the tax incentive, but the effect of that might just be to increase the cost of the researchers, ultimately.”

The survey findings suggest that there is an opportunity to expand R&D expenditure in the manufacturing sector, rather than exporting our raw materials to be developed into products elsewhere. “The findings of the survey show that we are not performing R&D at the level of a developed country,” Mustapha says. “The majority of innovations that we develop are not novel, they are based on the adaptation or imitation of technologies from overseas.”

Did you know? As a census survey, the National Survey of R&D collects data from every source of R&D in the country. “A very small percentage of South Africa’s 500,000 or so formal businesses do R&D, the bulk of which is performed by large firms,” Mustapha says, adding that the challenge for the survey team is to identify the smaller players and to keep abreast of new sources of R&D. The team is currently working on a new online interface to make the survey easier to complete, and to provide visual tools to make the findings more accessible and useful to organisations looking to compare themselves against sector averages.

The 2021/2022 survey is expected to be released in December 2022.

Edited by: Andrea Teagle, a science writer in the HSRC’s Impact Centre

Contact: Dr Nazeem Mustapha, a chief research specialist, Dr Mario Clayford, a research specialist and Natalie Vlotman, a senior researcher in CeSTII, and leader of the National Survey of R&D team.